wisconsin private party car sales tax

View this 52200 3 bed 20 bath 1334 sqft single family home located at 5941 Ponderosa Cir built in 1985 on Zillow. There is also between a 025 and 075 when it comes to county tax.

How To Sell A Car Privately In Texas Topmarq

Submit the original Proof of Publication to the Clerks office at least three business days prior to the date of the foreclosure saleOnline ForeclosureTax Deed SalesStarting Monday March 2 2009 online foreclosuretax deed sales will be held.

. Additional 5 if transaction takes place at the DMV. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. Visit your local DMV office with.

A completed TitleLicense Plate application Form MV1. The taxes can be different in the case of a. The county sales tax rate of 05 is imposed on retailers making taxable retail sales licenses leases or rentals or providing taxable services in a Wisconsin county that has adopted the county tax.

It might also be on the cars registration card and insurance documents. No permit fee is required for semi-trailers. Each state has different regulations for paperwork and fees when it comes to car sales.

The state of Florida has very simple rules. Titling fees are separate from any vehicle registration fees you may owe to the DMV. Top Are shipping handling subject to sales tax in Florida.

State Sales Tax amount subject to tax x 005 Local Sales Tax see instructions Loan Filing Fee 10 pay fee for each loan in Section D. The county use tax rate of 05 is imposed on purchasers of items used stored or consumed in counties that impose county tax. Whether the buyer realizes it or not there are important legal differences between buying a vehicle from a licensed dealership.

Wisconsin has state preemption laws which generally forbid cities from passing firearms or knife ordinances stricter than that of state law. Documents You Need When Buying a Car From a Private Party. If you buy from a private seller youll be the one completing the paperwork.

In addition to state and county tax the City of Chicago has a 125 sales tax. The Tax Foundation is the nations leading independent tax policy nonprofit. This 17-digit number is located on the lower left side of a cars windshield inside the hood on the engine or where the drivers side door closes.

Proof of identification eg. Real estate transfer fees. Local rental car tax.

The buyers legal options depend on the facts surrounding the sale but generally speaking the buyers rights are very limited when purchasing a vehicle from a private party. State rental vehicle fee. Local food and beverage tax.

Sales and use taxes. In most cases vehicles will be sold used for a lesser price than its original value. Year Make Type Car Truck Van etc Color Fleet No.

You can apply in person or by mail. Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. The Constitution of Wisconsin protects the right to bear arms in Article 1 Section 25 The people have the right to keep and bear arms for security defense hunting recreation or any other lawful purpose.

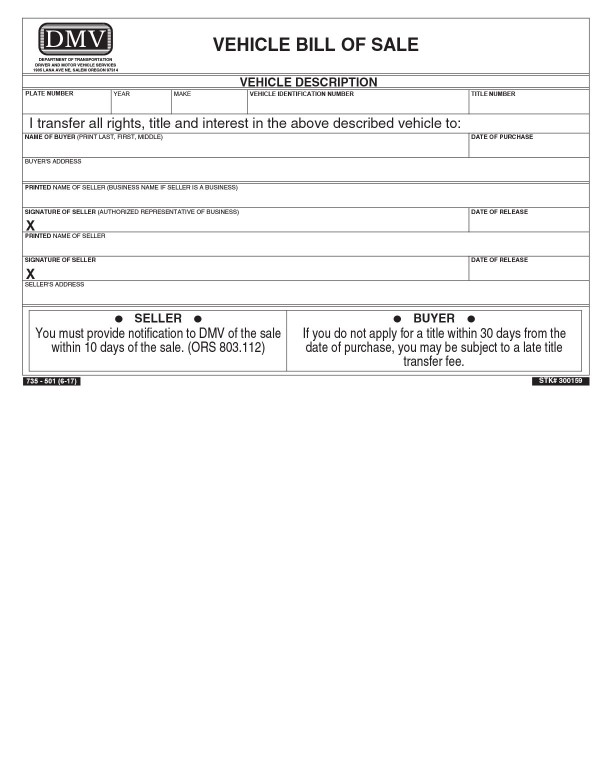

A vehicle private sales receipt is given to a buyer as proof of payment for the purchase of a car from a private sellerThe receipt may also be used to acknowledge the payment of a deposit towards the purchase price of a vehicle. File the original Notice of Sale with the Clerks Office with the 7000 electronic sale fee. Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels.

When you buy a car at a dealership they handle all the paperwork during the transaction. If you buy from a private party youll need to register the vehicle on your own. Car title transfer for surviving spouse or domestic partner.

If you have it look at the car title. There also may be a documentary fee of 166 dollars at some dealerships. Premier resort area taxes.

Updated July 11 2022. If theres a lien on the car the cars title might list the lien holder. Additionally you may be subject to a 5 sales or use tax plus a county tax if applicable.

Illinois collects a 725 state sales tax rate on the purchase of all vehicles. What is the county sales and use tax. County and special district sales and use taxes.

This means that a yoga instructor would not be required to collect sales tax while a private investigator may be required to collect sales tax. Vehicles Purchased from a Private Party. Different Sales Tax Rates Apply to Fuel.

Taxation of forest croplands. In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in. You can find a table describing the taxability of common types of services later on this page.

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Free Payment Plan Agreement Template Word Pdf Eforms

Used Bmw For Sale In Wisconsin Cargurus

New And Used Auto Educators Credit Union Wisconsin

Linnehan S Right Way Auto Cars For Sale Ellsworth Me Cargurus

Sedan Vehicles Enterprise Car Sales

Cars For Sale By Owner For Sale In Milwaukee Wi Cargurus

Cars For Sale By Owner For Sale In Milwaukee Wi Cargurus

Used Nissan Murano For Sale In Los Angeles Ca Cargurus

Trade In Car Or Sell It Privately The Math Might Surprise You

Cars For Sale By Owner For Sale In Milwaukee Wi Cargurus

Cars For Sale By Owner For Sale In Milwaukee Wi Cargurus

How To Sell A Car Privately In Texas Topmarq

All Vehicles Enterprise Car Sales

Used Bmw M5 Rwd For Sale With Photos Cargurus

Used Cars For Sale In Milwaukee Wi Under 4 000 Cars Com

Certified Pre Owned Cpo 2019 Chevrolet Traverse For Sale Cargurus